Income Tax Calculator for FY 2025-26 Excel

Please click below button to download Income Tax Calculator FY 2025-26 Excel (AY 2026-27)

Download – Income Tax Software with Form 16 | ||

| INCOME TAX CALCULATOR FOR RAJASTHAN (आयकर गणना Fy 2025-26) | ||

| Files Name | Financial Year | Download Link |

| Rajasthan Govt Employees Income Tax Calculator in Excel | 2025-26 | Click Here |

| Rajasthan Income Tax Calculator Excel (Police Department) | 2024-25 | Click Here |

| Rajasthan Income Tax Calculator Excel (Health Department) | 2024-25 | Click Here |

| Rajasthan Income Tax Calculator Excel (Dairy Fedration) | 2024-25 | Click Here |

| Income Tax Calculator Blank PDF | 2025-26 | Click Here |

| CENTRAL GOVERNMENT | ||

| Income Tax Calculator India Excel (Central Govt Employees) | 2025-26 | Click Here |

| UTTAR PRADESH | ||

| Uttar Pradesh Income Tax Calculator in Excel | 2025-26 | Click Here |

| MADHYA PRADESH | ||

| Madhya Pradesh Income Tax Calculator in Excel | 2025-26 | Click Here |

| BIHAR | ||

| Bihar Income Tax Calculator in Excel | 2025-26 | Click Here |

| UTTARAKHAND | ||

| Uttarakhand Income Tax Calculator in Excel | 2025-26 | Click Here |

| CHATTISGARH | ||

| Chattisgarh Income Tax Calculator in Excel | 2025-26 | Click Here |

| HARIYANA | ||

| Hariyana Income Tax Calculator in Excel | 2025-26 | Click Here |

| WEST BENGAL | ||

| West Bengal Income Tax Calculator in Excel | 2025-26 | Click Here |

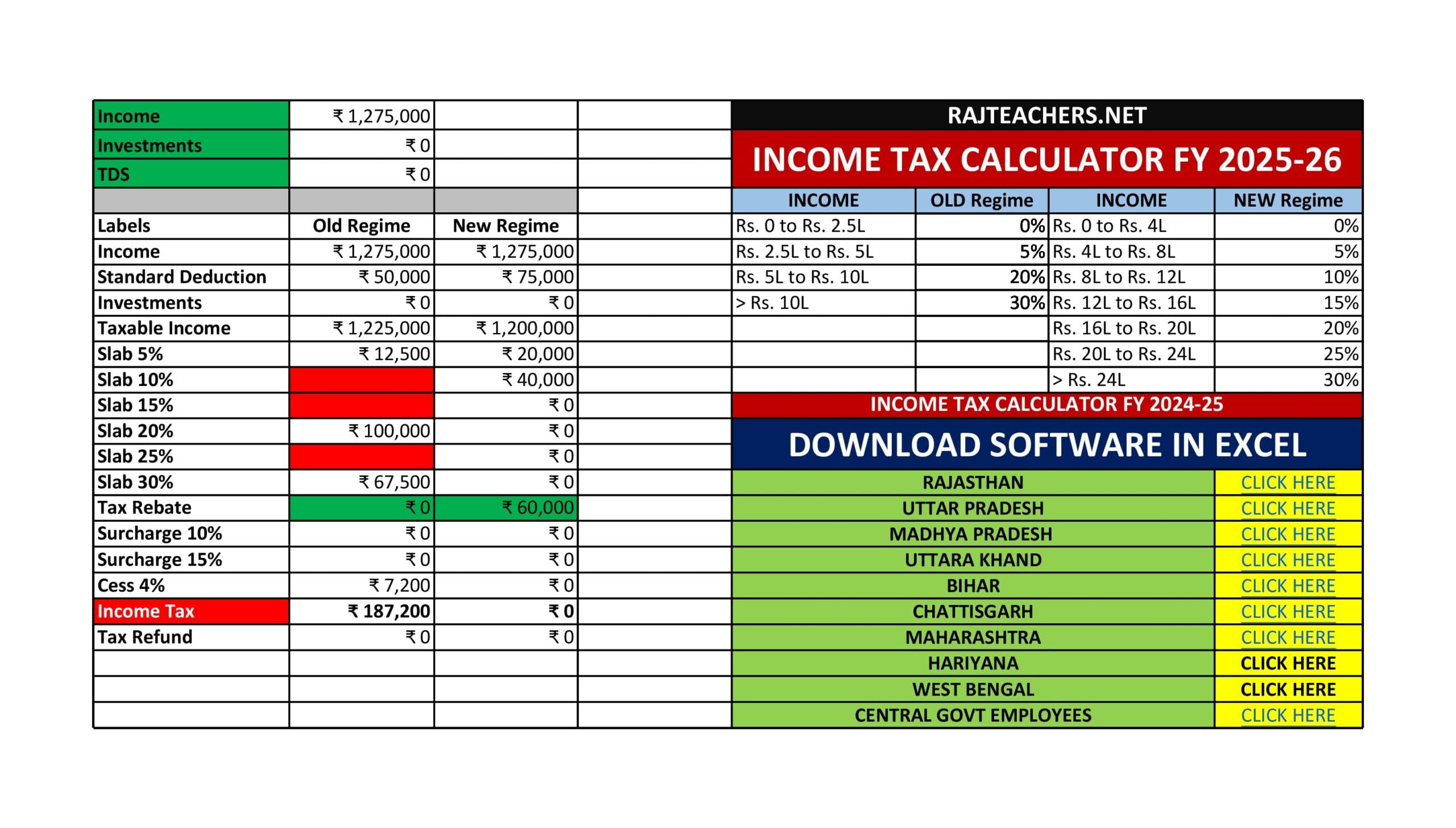

New Tax Regime (Applicable from April 1, 2025)

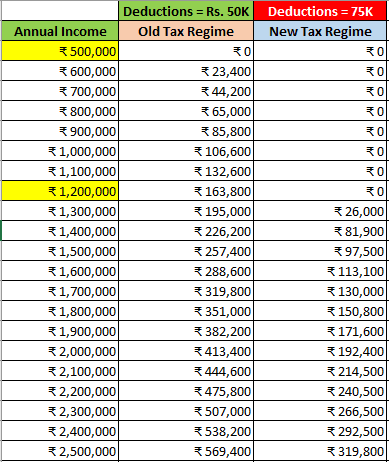

The New Tax Regime has been restructured to provide relief to taxpayers, especially the middle class. Notably, individuals with an annual income of up to ₹12 lakh will have zero tax liability due to enhanced rebates and standard deductions .Press Information Bureau+2ClearTax+2TaxGuru+2

Income Slabs and Tax Rates:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

Key Highlights:

Enhanced Rebate under Section 87A: Taxpayers with income up to ₹12 lakh are eligible for a rebate of ₹60,000, effectively reducing their tax liability to zero .Hindustan Times+2TaxGuru+2ClearTax+2

Standard Deduction: A standard deduction of ₹75,000 is available for salaried individuals, further reducing taxable income .ClearTax

Old Tax Regime

The Old Tax Regime continues to offer various exemptions and deductions, allowing taxpayers to reduce their taxable income through investments and expenses.

Income Slabs and Tax Rates:

| Income Range (₹) | Tax Rate |

|---|---|

| Up to ₹2,50,000 | Nil |

| ₹2,50,001 – ₹5,00,000 | 5% |

| ₹5,00,001 – ₹10,00,000 | 20% |

| Above ₹10,00,000 | 30% |

Available Deductions:

Section 80C: Investments in PPF, NSC, ELSS, etc., up to ₹1.5 lakh.

Section 80D: Premiums paid for medical insurance.TaxGuru

Section 24(b): Interest on home loan up to ₹2 lakh.

House Rent Allowance (HRA): Exemption based on rent paid and salary.

Standard Deduction: ₹50,000 for salaried individuals.

Calculate Your Tax with Our Updated Tool

To assist you in navigating these changes, our Income Tax Calculator for FY 2025-26 has been updated to reflect the latest tax slabs and deductions. Whether you’re considering the New or Old Tax Regime, our tool provides a comprehensive comparison to help you make an informed decision.

Features:

Real-time tax computation based on your inputs.

Comparison between New and Old Tax Regimes.

Inclusion of all relevant deductions and exemptions.

User-friendly interface accessible on all devices.

Start planning your taxes effectively and make the most of the benefits available to you. Try our calculator now: https://incometaxcalculator.tech/tax-calculator