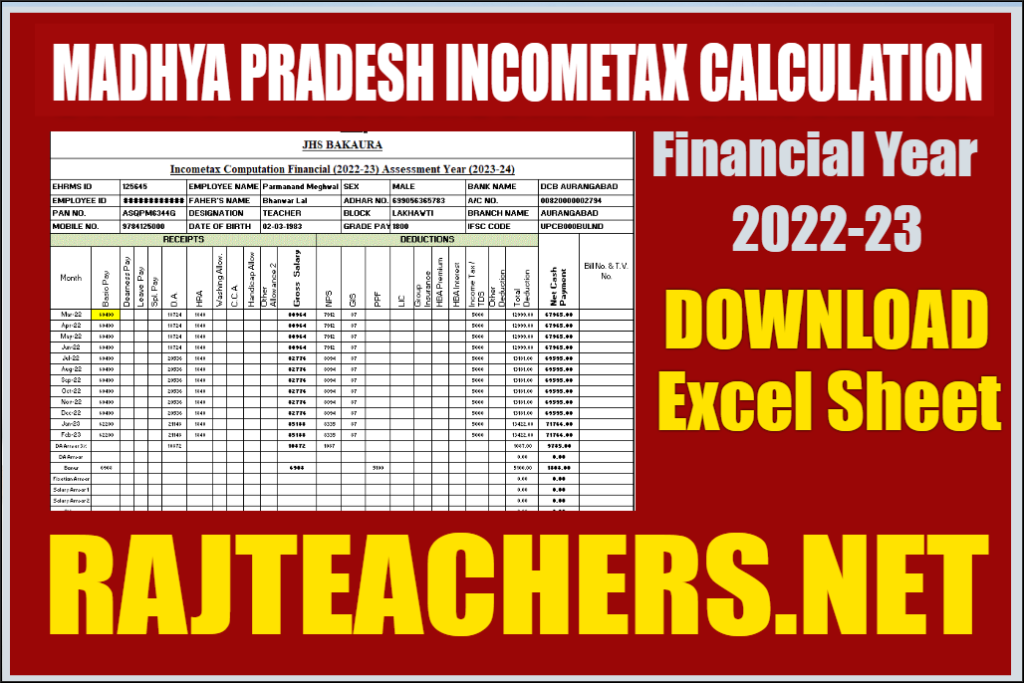

Madhya Pradesh Incometax Calculator 2023-24 in Excel

Income Tax

In the Union Budget 2022 which changed into introduced on 1 February 2022, there were no revisions or modifications withinside the present earnings tax slabs or earnings tax rates.

Income Tax is an instantaneous tax this is charged on an individual`s or entity’s earnings. The tax is calculated on the subsequent taxable earnings of the entity primarily based totally at the earnings slabs which can be pre-described with the aid of using the IT Department.

Download Click Here – For 7th Pay Commision

Download Click Here – For 6th Pay Commision

Note: You can now report your taxes via the New earnings tax portal. The New portal comes with a plethora of capabilities and is designed to ease the tax submitting process.

What is Income Tax?

Income tax is a tax charged on the annual income earned by an individual. The amount of tax paid will depend on how much money you earn as income over a financial year. One can proceed with Income tax payment, TDS/TCS payment, and Non-TDS/TCS payments online. All taxpayers must fill in the relevant details to make these payments. The entire process becomes simple and quick.

Income tax for FY 2022-23 applies to all residents whose annual income exceeds Rs.2.5 lakh p.a. The highest amount of tax an individual could pay is 30% of their income plus cess at 4% if their income is more than Rs.10 lakh p.a.

Taxpayers and Income Tax Slab Rates

In the Union Budget 2020, the Finance Minister of India has announced a new income tax slab. However, the new income tax regime is optional, and individuals can either opt for the new regime or file their taxes as per the old regime.

Income Tax slab under Old & New Tax Regime for FY 2023-24 & AY 2024-25

(Income Tax Rates & Slab for Individuals & HUF)

| Taxable income | Tax Rate (Old Tax Regime) |

Tax Rate (New Tax Regime) |

| Up to Rs. 2,50,000 | Nil | Nil |

| Rs. 2,50,001 to Rs. 5,00,000 | 5% (tax rebate u/s 87a is available) | 5% (tax rebate u/s 87a is available) |

| Rs. 5,00,001 to Rs. 7,50,000 | 20% | 10% |

| Rs. 7,50,001 to Rs. 10,00,000 | 20% | 15% |

| Rs. 10,00,001 to Rs. 12,50,000 | 30% | 20% |

| Rs. 12,50,001 to Rs. 15,00,000 | 30% | 25% |

| Above Rs. 15,00,000 | 30% | 30% |

Note:- Under the old tax regime, the basic exemption limit for a person of 60 years old or more but less than 80 years old is ₹ 3,00,000 and for person 80 years old or more is ₹ 5,00,000 Under the New tax regime tax slab is the same for all individuals irrespective of their age.

The profits earned people will decide the profits tax slabs beneathneath which they fall. The decrease the profits, the decrease the tax liability, and people who earn much less than Rs.2.five lakh p.a. are exempt from tax.Depending at the age of the character, the 3 classes that resident character taxpayers are divided into are referred to below.

- Individuals who are less than the age of 60 years old.

- Senior citizens who are above 60 years old and below 80 years of age.

- Super senior citizens who are above 80 years old.

Madhya Pradesh Professional Tax Slab Rate

Professional tax is the tax imposed via way of means of the authorities on all folks that are salaried specialists or are specialists including attorneys or doctors. This tax of Madhya Pradesh relies upon at the tax slab price widespread in Madhya Pradesh.

Professional Tax:

Professional tax is the tax levied via way of means of the Government of India on character incomes profits from profits or specialists including doctors, attorneys, accountants. Professional tax is imposed at country degree in India and every country has a exceptional technique of accumulating tax. Professional tax is a supply of sales for the authorities. Professional tax is obligatory in India similar to profits tax.

Professional Tax in Madhya Pradesh

Working professionals, buyers and those hired in different locations should pay expert tax if their income qualifies for it. The expert tax levied is accrued through the nation authorities of Madhya Pradesh and the tax levied relies upon at the expert tax slab price of Madhya Pradesh.

Professional Tax Slab Rate in Madhya Pradesh

Madhya Pradesh falls under the category of states that charge professional tax. The professional tax amount to be paid depends on the professional tax slab rate of the particular state. The tax slab rate is different for each year. Given below is the professional tax slab rate for Madhya Pradesh for the year 2022-2023.

| Monthly Salary/Income | Professional Tax |

| Up to Rs.18,750 | Nil |

| Rs.18,751 to Rs.25,000 | Rs.125 |

| Rs.25,001 to Rs.33,333 | Rs.167 |

| Rs.33,334 and above | Rs.208 for 11 months and Rs.212 for the last month |

The state of Madhya Pradesh levies professional tax of Rs.202 for first 11 months and professional tax of Rs.212 for the last month for individuals with salary above Rs.15,000.

INCOME TAX CALCULATION EXCEL FY. 2023-24 |

DOWNLOAD LINK |

|

RAJASTHAN EMPLOYEE INCOME TAX CALCULATION |

CLICK HERE |

|

UTTARAKHAND EMPLOYEE INCOME TAX CALCULATION |

CLICK HERE |

|

UTTAR PRADESH EMPLOYEE INCOME TAX CALCULATION |

CLICK HERE |

|

CHHATISGARH EMPLOYEE INCOME TAX CALCULATION |

CLICK HERE | |

MADHYA PRADESH EMPLOYEE INCOME TAX CALCULATION |

CLICK HERE |