U.P. INCOME TAX CALCULATOR FY 2024-25 (AY 2025-26)

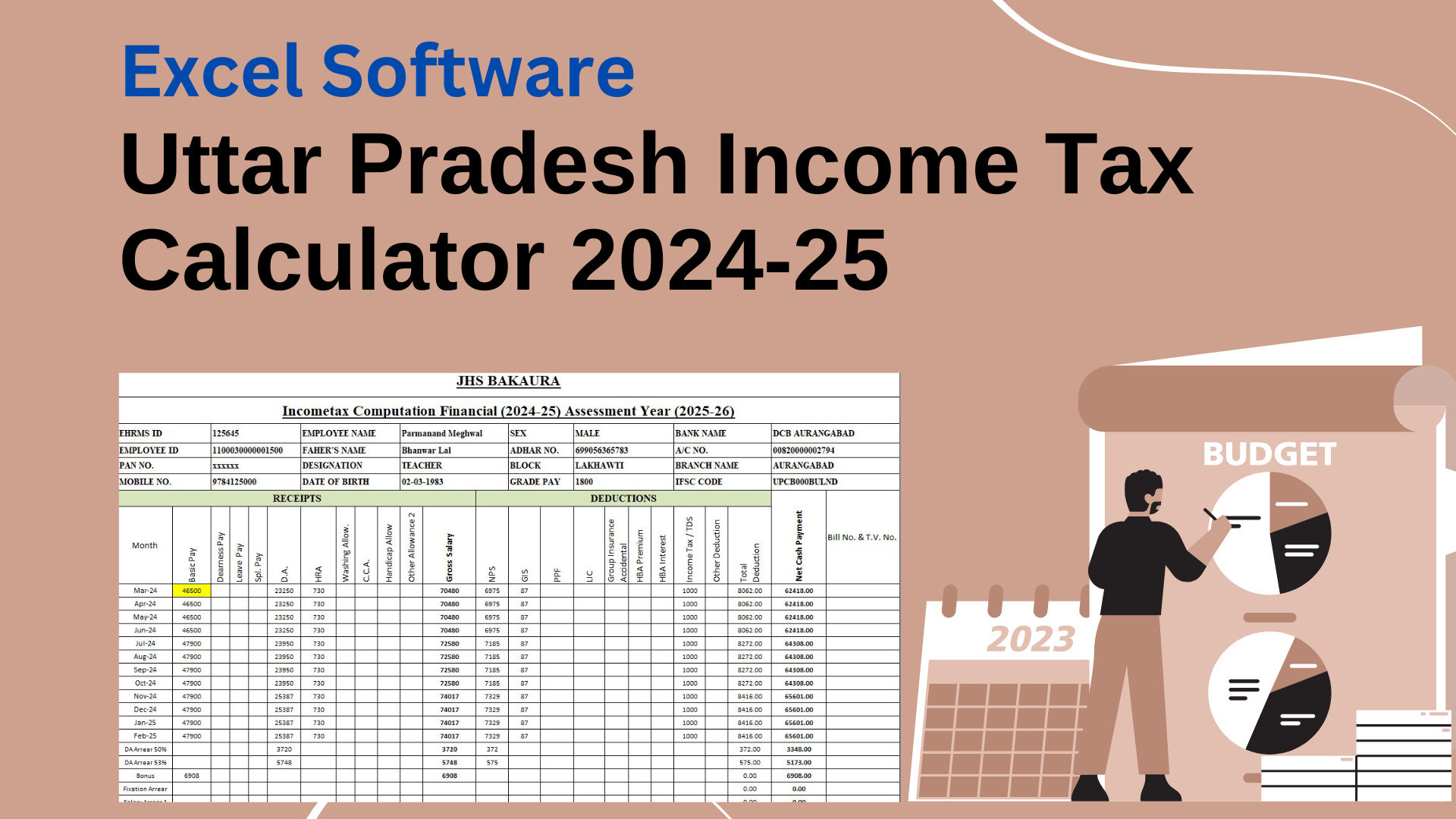

Uttar Pradesh Incometax Calculator 2024-25

Uttar Pradesh Incometax Calculator |

Download Click Here

How to use the Income Tax Calculator?

- This is an offline tool which is built in MS Excel.

- This software is for the employees of Uttar Pradesh in the financial year Designed to calculate income tax for 2024-25

- After downloading the software, it can be done easily.

- Incometax software will automatically calculate your tax amount according to income.

- The software is made in 5 parts. (i) Salary (ii) Other Deductions (iii) Tax Old Regime (iv) Tax New Regime (v) Form 16

The steps to use the tool are as given below –

(i) Salary –

- Are You an Employee of The “NPS” Yes Or No (Select This Cell)

- Select Your City – Rural Or Urban.

- Select Your Grade Pay Level

- Select Are You Senior Citizen “Yes” Or “No”

- Select Bonus “Yes” Or “No”

- Mention Your School Name Or Office Name.

- Fill Employee Personal Data.

- Fille Basic Payment of March 2024.

(ii) Other Deductions –

- Fill Other Deductions whose Income tax Exemption you want.

(iii) Old Tax Regime –

- This sheet will show the Calculation as per the old income tax calculation by the Income Tax Department.

- This sheet will be Prepared Automatically, in which you will see all the Calculations of your Income Tax.

(iv) New Tax Regime –

- This sheet will show the Calculation as per the New income tax calculation by the Income Tax Department.

- This sheet will be Prepared Automatically, in which you will see all the Calculations of your Income Tax.

Tax slabs under Old V/s New Tax regime

INCOME RATES & SLAB RATES FOR F.Y. 2024-25

(Income Tax Rates & Slab for Individuals & HUF)

| Taxable income | Tax Rate (Old Tax Regime) | Tax Rate (New Tax Regime) |

| Up to Rs. 3,50,000 | Nil | Nil |

| Rs. 3,00,001 to Rs. 7,00,000 | 5% (tax rebate u/s 87a is available) | 5% (tax rebate u/s 87a is available) |

| Rs. 7,00,001 to Rs. 10,00,000 | 20% | 10% |

| Rs. 10,00,001 to Rs. 12,00,000 | 20% | 15% |

| Rs. 12,00,001 to Rs. 15,00,000 | 30% | 20% |

| Above Rs. 15,00,000 | 30% | 30% |

Note:- Under the old tax regime, the basic exemption limit for a person of 60 years old or more but less than 80 years old is ₹ 3,00,000 and for person 80 years old or more is ₹ 7,00,000 Under the New tax regime tax slab is the same for all individuals irrespective of their age

Health & Education Cess – 4%

Uttar Pradesh Incometax Calculator Fy 2024-25 In Excel |

Download Click Here

How to calculate Income Tax?

We will try to understand the Old Tax Regime and the New

Tax Regime with the help of an Example.

Example:-

Income tax slabs (2024-25)

It is always best to know in advance what is the tax payable amount based on your income and investments. The income tax calculator helps calculate your taxable income and also the tax payable as per the income tax slabs rate applicable.

New income tax slabs for FY 2024-25

| Taxable income | New Tax Regime Rate |

| Up to Rs. 3,00,000 | NIL |

| Rs. 3,00,000 – Rs. 7,00,000 | 5% on income, which exceeds Rs. 3,00,000 |

| Rs. 7,00,000 – Rs. 10,00,000 | Rs. 20,000 + 10% on income, which exceeds Rs. 7,00,000 |

| Rs. 10,00,000 – Rs. 12,00,000 | Rs. 50,000 + 15% on income, which exceeds Rs. 10,00,000 |

| Rs. 12,00,000 – Rs. 15,00,000 | Rs. 80,000 + 20% on income, which exceeds Rs. 12,00,000 |

| Above Rs. 15,00,000 | Rs. 1,40,000 + 30% on income, which exceeds Rs. 15,00,000 |

New income tax slabs for FY 2024-25

New income tax slabs for individuals between 60 and 80 years (senior citizens)

| Taxable income | New Tax Regime Rate |

| Up to Rs. 3,00,000 | NIL |

| Rs. 3,00,000 – Rs. 7,00,000 | 5% |

| Rs. 7,00,000 – Rs. 10,00,000 | 10% |

| Rs. 10,00,000 – Rs. 12,00,000 | 15% |

| Rs. 12,00,000 – Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% |

New income tax slabs for aged 80 and above (super-senior citizens)

| Taxable income | New Tax Regime Rate |

| Up to Rs. 5,00,000 | NIL |

| Rs. 5,00,000 – Rs. 10,00,000 | 20% |

| Above Rs. 10,00,000 | 30% |

Uttarakhand State Incometax Calculation 2024-25 In Excel

Download – Income Tax Software with Form 16 | ||

| INCOME TAX CALCULATOR FOR RAJASTHAN (आयकर गणना Fy 2024-25) | ||

| Files Name | Financial Year | Download Link |

| Rajasthan Govt Employees Income Tax Calculator Excel (Education) | 2024-25 | Click Here |

| Rajasthan All Employees Tax Calculator Excel | 2024-25 | Click Here |

| Rajasthan Income Tax Calculator Excel (Police Department) | 2024-25 | Click Here |

| Rajasthan Income Tax Calculator Excel (Health Department) | 2024-25 | Click Here |

| Rajasthan Income Tax Calculator Excel (Dairy Fedration) | 2024-25 | Click Here |

| Income Tax Calculator Blank PDF | 2024-25 | Click Here |

| CENTRAL GOVERNMENT | ||

| Income Tax Calculator India Excel (Central Govt Employees) | 2024-25 | Click Here |

| MAHARASHTRA | ||

| Maharashtra Income Tax Calculator in Excel | 2024-25 | Click Here |

| UTTAR PRADESH | ||

| Uttar Pradesh Income Tax Calculator in Excel | 2024-25 | Click Here |

| MADHYA PRADESH | ||

| Madhya Pradesh Income Tax Calculator in Excel | 2024-25 | Click Here |

| BIHAR | ||

| Bihar Income Tax Calculator in Excel | 2024-25 | Click Here |

| UTTARAKHAND | ||

| Uttarakhand Income Tax Calculator in Excel | 2024-25 | Click Here |

| CHATTISGARH | ||

| Chattisgarh Income Tax Calculator in Excel | 2024-25 | Click Here |

| HARIYANA | ||

| Hariyana Income Tax Calculator in Excel | 2024-25 | Click Here |

| WEST BENGAL | ||

| West Bengal Income Tax Calculator in Excel | 2024-25 | Click Here |